Consumption tax: Qualified invoice

Hello. How are your summer? I live in Kansai, and this year we don’t have much rain, then it is so hot and humid summer as well as every year.

I enjoyed snorkeling a couple of days in sea shore, very refreshed and good opportunity to restart new days for bsiness.

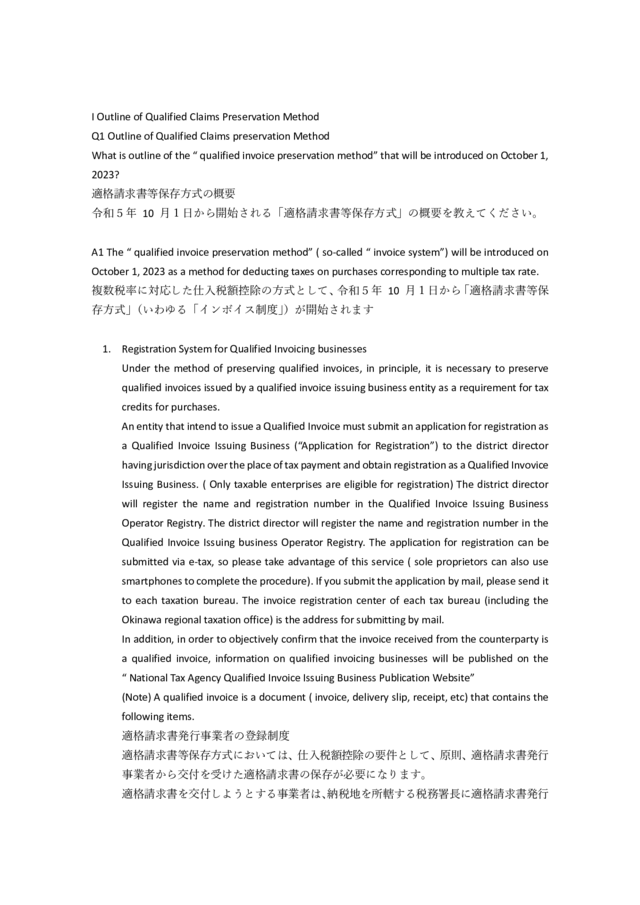

As you know, in Japan consumption tax, a qualified invoice system will start from October 1, 2023 ( next year).

This system was announce four or five years ago ( 2018), but soon after covid pandemic has began, then we wondered if the government went to new system or not. Because consumption tax are very connected to economy situation.

We realized government will perform new system 100% surely, then I am learning how the qualified invoice are.

There is guideline by government and I will update one by one ( total Q &A is 101).

- Registration to tax office for qualified invoice business ( we are )

- Issue qualified invoice with qualified tax number, etc to business counterparty

- Exempt case for qualified invoice

- Requirement for tax credit

Please see attached for more details.

日本語

日本語