Qualified invoice: Q10 Procedure for electing the simplified taxation system

Typhoon is coming, but luckily our area are safe. Not strong wind and not much rain. I can hear insect sounds, then typhoon is passing away from this area. But I am sorry to hear Okinawa, Kyushu area have been suffered big damage due to extreme strong wind and heavy rain.

Now we are in Ohigan. We are told the Ohigan is when the deceased person comes to the shore closest to this world to greet us, so we also go to the shore closest to that world to greet them.

The autumn ohigan is from September 20 to September 26 this year and the spring ohigan is from March 18 to March 24 next year.

It is said that hot weather lasts until the autumn ohigan, and cold weather lasts until the spring ohigan.

Then we will graduate from hot summer and enter autumn soon.

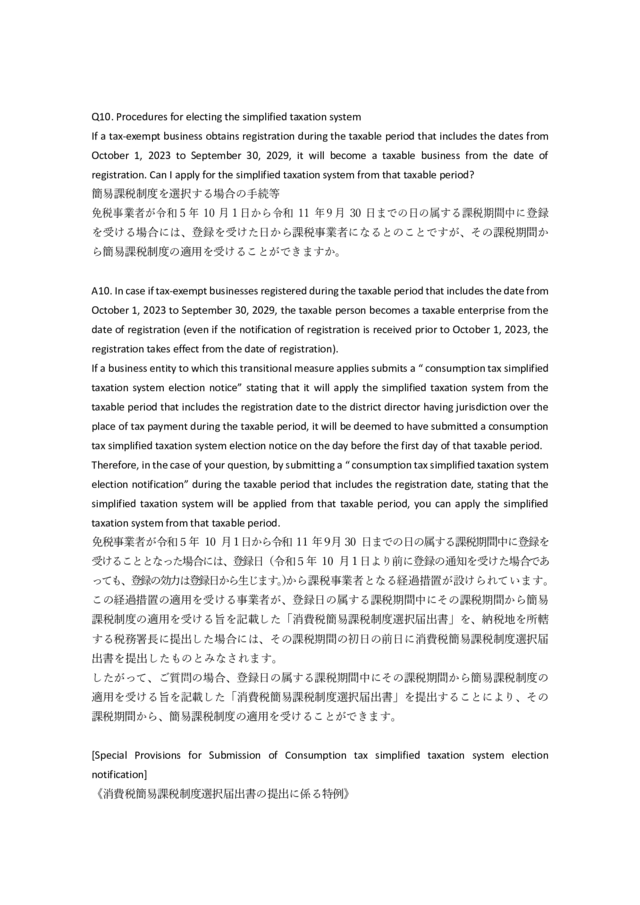

Today, we learn simplified tax system when we registered qualified invoice business.

Simplified tax system means consumption tax calculation is calculated only based on sales amount, and taxable purchase ( deductible purchase) are fixed as rate according to business.

Deductible purchase rate:

Type 1: 90% Wholesale

Type2: 80% Retail

Type3: 70% Construction, Manufacturing, Mining, Agriculture, Forestry, Fishing

Type 4:60% Restaurant

Type5: 50% Service

Type 6: 40% Real estate

But in case of meeting of requirement, taxable sales amount is under 50,000,000 JPY ( in two years ago)

Example: Whole sale, annual sales amount 10,000,000 JPY

10,000,000 JPY*10%*(1-0.9)=100,000 JPY, this is due consumption tax.

So Japanese simplified tax system is different from other countries, I think.

And back to qualified invoice matter, during October 1, 2023 to September 30, 2029, when you applied qualified invoice business and also applied simplified invoice business, you can start qualified invoice and simplified invoice effective from the date accepted by tax office.

Please see more details.

Thank you

日本語

日本語