Qualified invoice Q17, Cancellation of registration

I do tax work for foreigners living in Japan. I file tax returns for my clients with the partner who files the U.S. returns especially for those who are U.S. citizens or U.S. nationals, because they must file in the U.S. regardless of their country of residence. (Only for those with income above a certain threshold, though.)

The other day I had a confirmation about IRAs, which are literally Individual Retirement Accounts, and the gains on the investments are not taxed until retirement, but when you reach, say, age 70, you are forced to withdraw from the IRAs. Only when you withdraw the money, i.e., when you have the money in your account, is it taxed.

IRAs are similar to NISA in Japan. The investment gains are not taxed. However, NISA is also tax-exempt when withdrawing and disposing of the investment.

The income from withdrawals is miscellaneous income (public pension) in IRA .

When you contribute on IRA, you have the option of deducting your contribution as a deduction or not. Most people choose to take the deduction, but if you do, the entire amount will be subject to tax when you withdraw it. If you do not take deduction, the money you have contributed is simply your own money, and only the portion of the amount that corresponds to investment income is subject to taxation.

This was clearly understood the other day. There are various financial products in the U.S., and it is difficult to know how they are taxed in Japan, but I am very confident now that I understand IRAs clearly.

I am ashamed to say that I finally understood it after being involved with it for more than 10 years. It took me a long time.

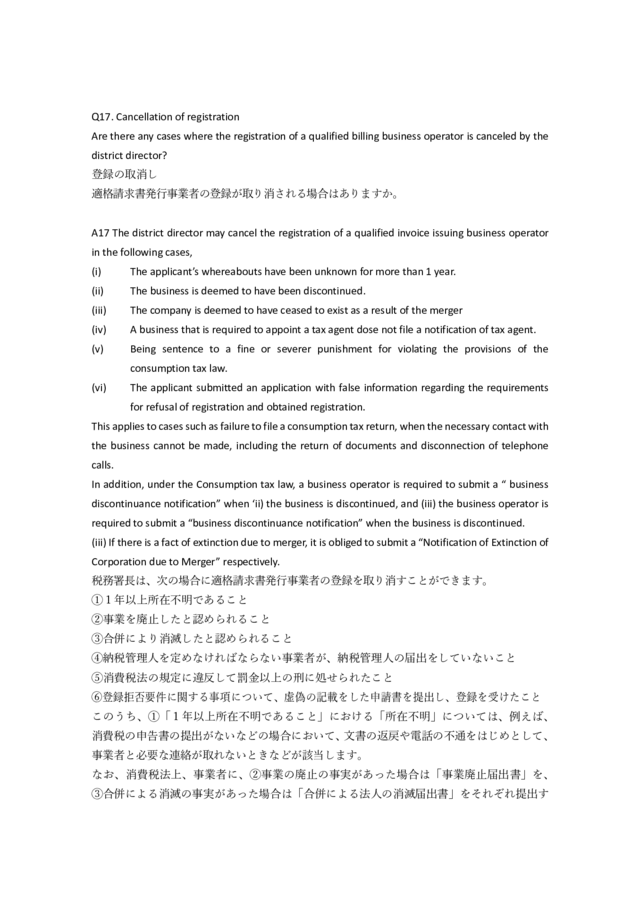

Today, I would like to talk about Qualified Invoice Q17, Cancellation of Registration.

This is not a case where you want to stop using the taxpayer’s name, but a case where the tax office asks you to prohibit the use of the taxpayer’s name.

Normally, you will not be banned, but the following cases will result in a decision to revoke your registration.

Unknown whereabouts

Business discontinuation

Merger or dissolution

Absence of a tax agent

False statement

In all cases except for false statements, the tax office will decide to cancel the application if the reason such as inability to contact the tax office is applicable. It is only natural.

False statements are also a matter of course.

日本語

日本語