Qualified Invoice Q18: Tax exempt business

Yesterday I went to Chinese restaurant and enjoyed Chinese food with friends. I went by train, and on the train I saw the president of a former client of mine and called out to her. I asked her, “How are you?” She replied, “Not well.” The company is going through a hard time, and she seemed to be having a hard time with her own health as well. I am worried about her because she is an elderly person. But it was good to see her after a long time. I was thinking of going by car, but I am glad I decided to take the train because of chance meeting her again.

In the restaurant, I had a lot of fun with my friends, reporting on the current situation of each of us. I was impressed that they were talking passionately about the future while the world is full of downbeat stories. I was also talking about some crazy dreams for the future, as things have been going better recently.

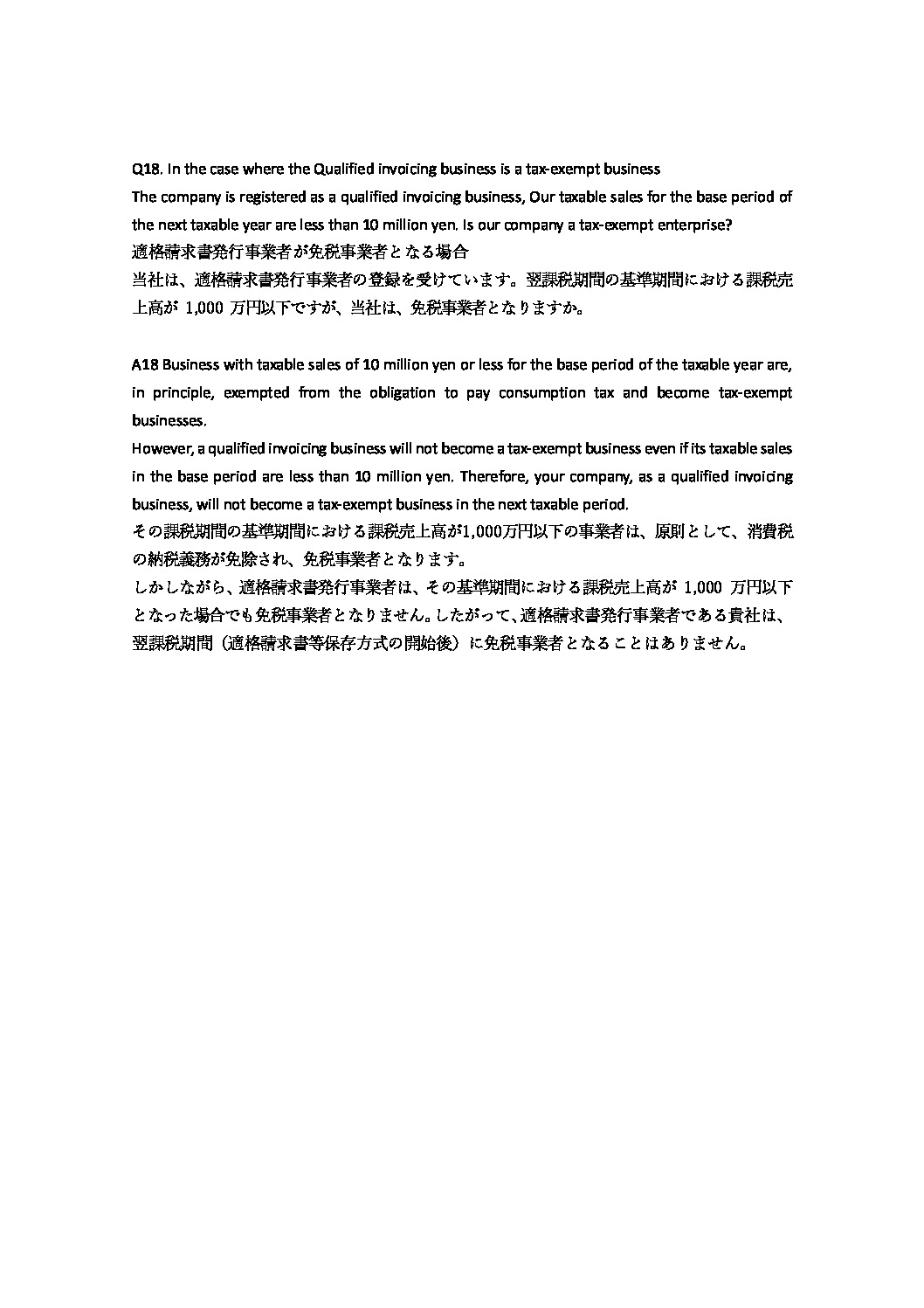

Today, I would like to talk about Qualified Invoice Q18: When an entity becomes a tax-exempt business.

Even if a Qualified Invoice Business becomes a tax-exempt business, that is, even if its sales two years ago were less than 10 million yen, it cannot become a tax-exempt business once it has registered as a Qualified Invoice Business. If you wish to become a tax-exempt business , you must apply for cancellation of registration at least 30 days prior to the last day of the fiscal year in which you wish to become a tax-exempt business. Please refer to Q14 for details.

This invoice system is most complicated for tax-exempt businesses. Tax-payer business will be OK as there is almost no change from the previous system, but tax-exempt business themselves have to do a lot of hard work and that counterparty have to think about how to deal with that tax-exempt business.

Please refer to below text for furthermore.

Thank you very much!

English

English